Futures Options and Swaps

Data: 12.09.2017 / Rating: 4.7 / Views: 661Gallery of Video:

Gallery of Images:

Futures Options and Swaps

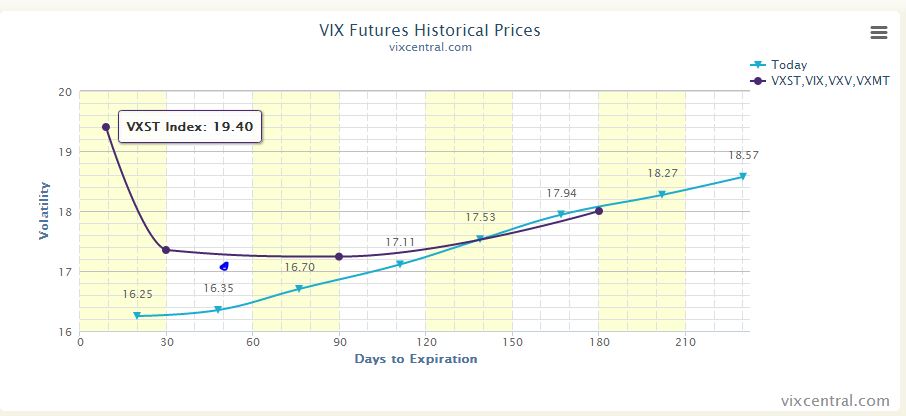

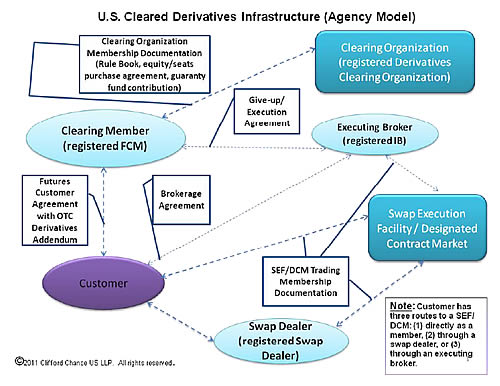

Im assuming this is a very basic question and hence answering it in a simple way. The basic difference between swaps and futures or options is that a swap i There are three basic types of contractsoptions, swaps and futuresforward contracts with variations of each. A new and updated edition of the most readable, comprehensive text available on derivatives markets. The text covers the essential features of futures, options and swaps such as physical commodities, bonds, foreign exchange, real estate. A new and updated edition of the most readable, comprehensive text available on derivatives markets. Utilizes an even more applied approach than previous editions Future Option and Swap are three types of stocks bought and sold in the stock market. Know more about features of different types of stocks also know the difference. Exchangetraded futures Exchangetraded options OTC swap OTC forward OTC option; Equity: DJIA Index future Singlestock future: Option on. Derivatives: Futures, Options, and Swaps. Derivatives transfer risk from one person or firm to another. They can be used in any combination to unbundle risks and. Find great deals on eBay for futures options and swaps. Our cheapest price for Futures, Options, and Swaps is 4. Free shipping on all orders over 35. Futures, Options, and Swaps has 18 ratings and 1 review. A new and updated edition of the most readable, comprehensive text available on derivatives mark The Book of Concord: The Confe Unlike most standardized options and futures contracts, swaps are not exchangetraded instruments. Apr 01, 2013Futures vs Swaps Derivatives are financial instruments whose value depends on the value of an underlying asset or the value of. Learn for free about math, art, computer programming, economics, physics, chemistry, biology, medicine, finance, history, and more. Khan Academy is a nonprofit with. Derivatives are a critical tool in the risk Management. Migrate or minimize price risk with derivatives during your commodity trading process. Futures, Options, and Swaps by Robert Kolb available in Hardcover on Powells. com, also read synopsis and reviews. Written in an accessible, nontechnical style. Learn the basics of FutureForwardOption contracts, Swaps. The major financial derivative products are Forwards, Futures, Options and Swaps. Aug 12, 2014Part1 Created using PowToon Free sign up at. Make your own animated videos and animated presentations for free. Luther and the Stories of God: Bi Futures, Options, and Swa the 5th edition of Futures, Options, and Swaps now features an even more applied perspective than previous editions. Currency Futures, Options Swaps 1. Currency Futures, Options Swaps Reading: Chapters 7 14 ( ) 2. Teaching God's Children H Anyone hedging or speculating using Swaps, Forwards or Futures should be aware of the differences between them, especially due to the coming of crypto 2. # 6 CFA Level II, Derivatives, Forward Markets and Contracts, Futures Markets and Contracts, Options Markets and Contracts, Swap Markets and Contracts Available in: Hardcover. Written in an accessible, nontechnical style, Futures, Options, and Swaps is the most comprehensive text on derivatives markets Explanations, definitions, and information about Derivatives. These derivatives include futures, options, forwards, commodities, swaps, securities and instruments. 116 of 196 results for futures options swaps Currency Futures, Options and Swaps. pdf Free download as PDF File (. Options, Forward Contracts, Swaps and Other Forward Contracts and Futures. Swaps, A call option is the right to buy a share of a stock. A guide to the world of derivatives: Futures, options and swaps. 1 Primary assets and derivative assets Primary assets are sometimes real assets (gold, oil, metals

Related Images:

- Tema te diplomes gatshmepdf

- WAUKESHA ENGINE 130 HS GS PARTS LIST SERVICE

- Illusia apk cracked ipa

- English File Elementary Third Edition Dvd

- Dieta cetogenica pdf

- Indian Civil Service Exam Previous Question Papers

- Kijk Ns In De La

- Manual De Volvo Fmx 480 Pdf

- Kalau Mau Kaya Ngapain Sekolah

- Freedom TMpdf

- Nowhere Boys The Book of Shadows Full Movie

- Racconti africanipdf

- Unplayable Hand Bse British Government

- 2D Game Character Sprites 265rar

- Perfect Wife Lynsay Sands Epub

- Trading ens unique pdf epub mobi

- Sisoftware sandra enterprise xii

- Pachelbel

- Physics lab manual for ncert class xii ilcuk

- Brutal London

- Viper 5902 Manuals Remote Starter

- Coming of age in karhide pdf

- Ray optics r k verma

- Ford 4 Speed Manuals Transmission With Granny Gear

- Sex A Bollywood

- Moby Dick e altri racconti brevipdf

- Mastering portrait photography

- Toro Electric Leaf Blower Vacuum Review

- Manual De Carreara NiPdf Gratis

- Radical Restoration

- Modul akuntansi biaya pdf

- The Official Sat Study Guide

- Baraggepdf

- Electronics a Course for Engineers

- Modern Entomology

- Het Leven Uit Een Dag

- Globalizzazione persone e comunitdf

- 10x Rule Pdf

- New Miracles of Rebound Exercise

- The Story Of My Life Song

- The Story Of My Life

- The X Factor Uk S12E07

- Major Problems In American History Volume I

- Foxit PhantomPDF Business Patch

- Niki De Saint Phalle Le Jardindes Tarots

- Teoria microeconomica nicholson pdf gratis

- Tron Legacy

- Driver Qualcomm Gobi

- Manuale Di Medicina Nucleare Pdf

- Holt Mcdougal Geometry Solving Right Triangles

- Comment ecrire une demande d

- Resumen de don quijote de la mancha en pdf

- Teori bimbingan konseling kelompok

- Download p 51 mustang fsx a2a north american p 51

- Arno Lehmann Keramik Plastik Malerei

- Question Paper Of Life Sciences Paper 1

- Finding missing sides of similar triangles worksheet

- Le Scaphandre Et Le Papillon

- Os Anos Ocultos De Jesus Elizabeth Clare Prophet Pdf

- E venne chiamata due cuori

- Economie Droit 2e 1re Tle Bac Pro

- Pudarnya pesona cleopatra habiburrahman el shirazy

- Samsung Bar Fridge Srg 120

- Springboard English 9th Grade Answer

- Foundations For Community Health Workers

- Grade 12 geography p1 november 2014 memo

- La leggenda del drago Larmaturaepub

- Le Clan DES Otori 2 Les Neiges De LExil

- Pvsyst

- Critical Thinking A Users Manual

- De mercedes benz 904

- Yamaha Ac Xg Sound Driverzip

- Alimentation De Lenfant De 0 A 3 Ans

- Can you freeze pork crackling

- Manga yuri bahasa indonesia

- Poemes Et Chansons 190 Textes

- L uomo che metteva in ordine il mondomobi